Newcastle Permanent’s annual financial results have highlight its sustained outperformance of other retail banking organisations in its core business of home lending, with a 53% increase in home loan portfolio growth from the previous financial year.

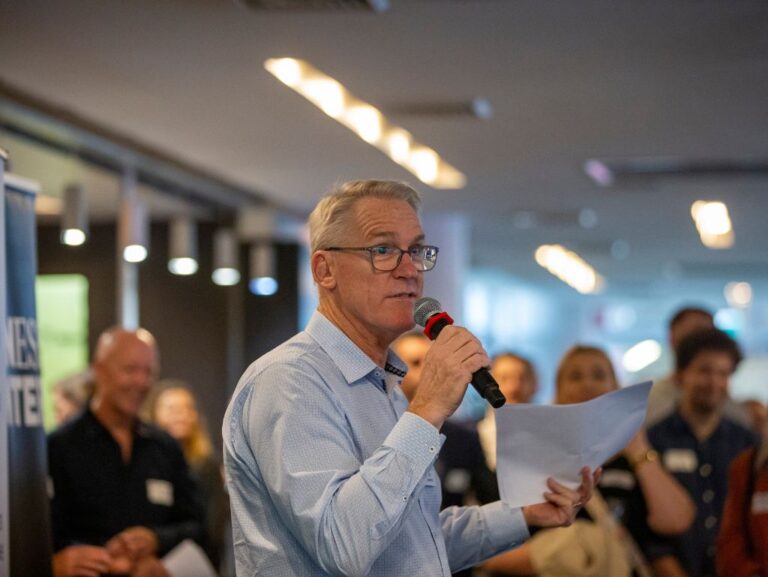

“In 2014-15 the home lending market was characterised by historically low interest rates, exceptionally high levels of customer repayments and continued strong competition from the major banks,” Chairman Michael Slater said.

“Newcastle Permanent has withstood unprecedented market conditions and emerged with strong home loan portfolio growth of 4.9%, which is a 53% increase on the prior year. This excellent performance was achieved while also completing the implementation of a new state-of-the-art home loan processing system.”

Newcastle Permanent is the largest customer-owned banking institution in NSW with total assets of almost $9 billion, and ranks as one of the top 20 Australian retail banking institutions. They now employ almost 1,000 people throughout NSW and maintains a Tier 1 Capital Ratio of 20% with total assets now nearly $9 billion.

Michael said during the last seven years Newcastle Permanent had invested more than $60 million in major projects to improve the business’s infrastructure and introduce advanced customer facing technology to better meet customers’ needs and drive growth across the business.

Newcastle Permanent achieved a net profit after tax for 2014-15 of $36.5 million plus a $52.2 million mutuality dividend.

CEO Terry Millett said Newcastle Permanent’s customer focus stood out to its customers as a high quality and better value alternative to the major banks.

“The success of our business model translates in Newcastle Permanent’s customer satisfaction score of 95%, more than 10 percentage points higher than the best of the major banks, and our Home Lender of the Year titles from two of the industry’s top financial publications ‚Äì Money magazine and the Financial Review’s Smart Investor Magazine,” Terry said.

“Newcastle Permanent’s position as a preferred home lender with a growing presence in the metropolitan market is no coincidence. We have more than $1.2 billion of home loans in the Sydney market and more than $3 billion outside of the Hunter region. We use our customer-owned banking model to deliver superior value and service to customers over the long-term,” he said.

Image | Newcastle Permanent Chairman Michael Slater