Newcastle has always been a popular choice for property investors, but recent developments have made it even more enticing.

Emerging new infrastructure in the city and affordable property prices have meant that investors are not shying away from this gold mine.

The New South Wales Government’s urban renewal plan for the town includes a $500 million new light rail and transport interchange development due for completion by 2019. The plan also involves new parks, public spaces and entertainment precincts. Research appointed by the Newcastle Renewal Taskforce indicates the light rail and urban renewal will provide a $2.5 billion boost to the local economy.

On the smaller spectrum of Newcastle’s commercial space, young innovators are setting up shop to appeal to this thriving community. Evolving new businesses such as Pushing Pansies, Black Sheep Café Bar and Barcito have contributed to the town’s popularity.

Regardless of whether or not these business owners bought or leased their property, taking advantage of depreciation deductions can help cover some of the initial costs involved with starting a new business.

The Australian Taxation Office (ATO) allows commercial property owners to claim a deduction each financial year for the wear and tear of the building structure and for the plant and equipment items it contains. Depreciation is available to any property owner who earns an income from that property.

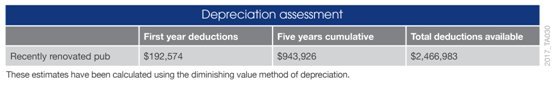

The following table provides an example of the deductions available for an owner of a recently renovated pub:

Commercial property tenants can also claim depreciation for any fit-out they add once their lease commences.

Commercial property owners can simultaneously claim deductions for plant and equipment items originally found in the property.

To ensure that depreciation deductions are maximised for both owners and tenants, it is recommended that both parties contact a specialist Quantity Surveyor to arrange a tax depreciation schedule. A Quantity Surveyor can provide two separate schedules for the owner and the tenant, which will outline the deductions available for each party.

These deductions are beneficial to both tenants and owners as they help reduce their taxable income and, as a result, improve their cash flow and reduce the annual costs of renting or holding the property.